Why Australia's Managed Funds Are Vital for Sustainable Urban Growth

Exploring Managed Funds

Navigating the world of managed investments can feel overwhelming, but it's a worthwhile journey, especially for those eager to blend financial growth with sustainability. Imagine this process as if you're walking through the serene, lush landscapes of the Royal Botanic Gardens Victoria. The gardens, with their unique arrangements and careful planning, mirror the stability and thoughtful design you can expect in a well-chosen investment fund.

Managed funds pool money from multiple investors to collectively invest in a diversified portfolio, which allows you to participate in a wider range of assets than you could on your own. Within this investment landscape, you have options like shares, bonds, property, and more. One of the most appealing aspects of managed funds is professional asset management, where experts make the critical investment decisions, much like how an urban planner would strategically develop a thriving Melbourne Docklands.

Your choices aren't solely limited to shares or bonds. Investing in a cash investment fund could be particularly interesting, providing gross returns with relatively lower risk. This fund focuses on short-term interest-bearing assets, offering a more stable yet modest growth potential.

When considering managed funds, think about the sustainable planning principles in projects throughout Fitzroy. By aligning your investment strategy with eco-friendly goals, you can contribute to sustainable growth while working towards your financial goals. This approach ensures your investments not only generate returns but also support innovative solutions for a greener future.

Impact on Urban Growth

Facilitating Infrastructure Development

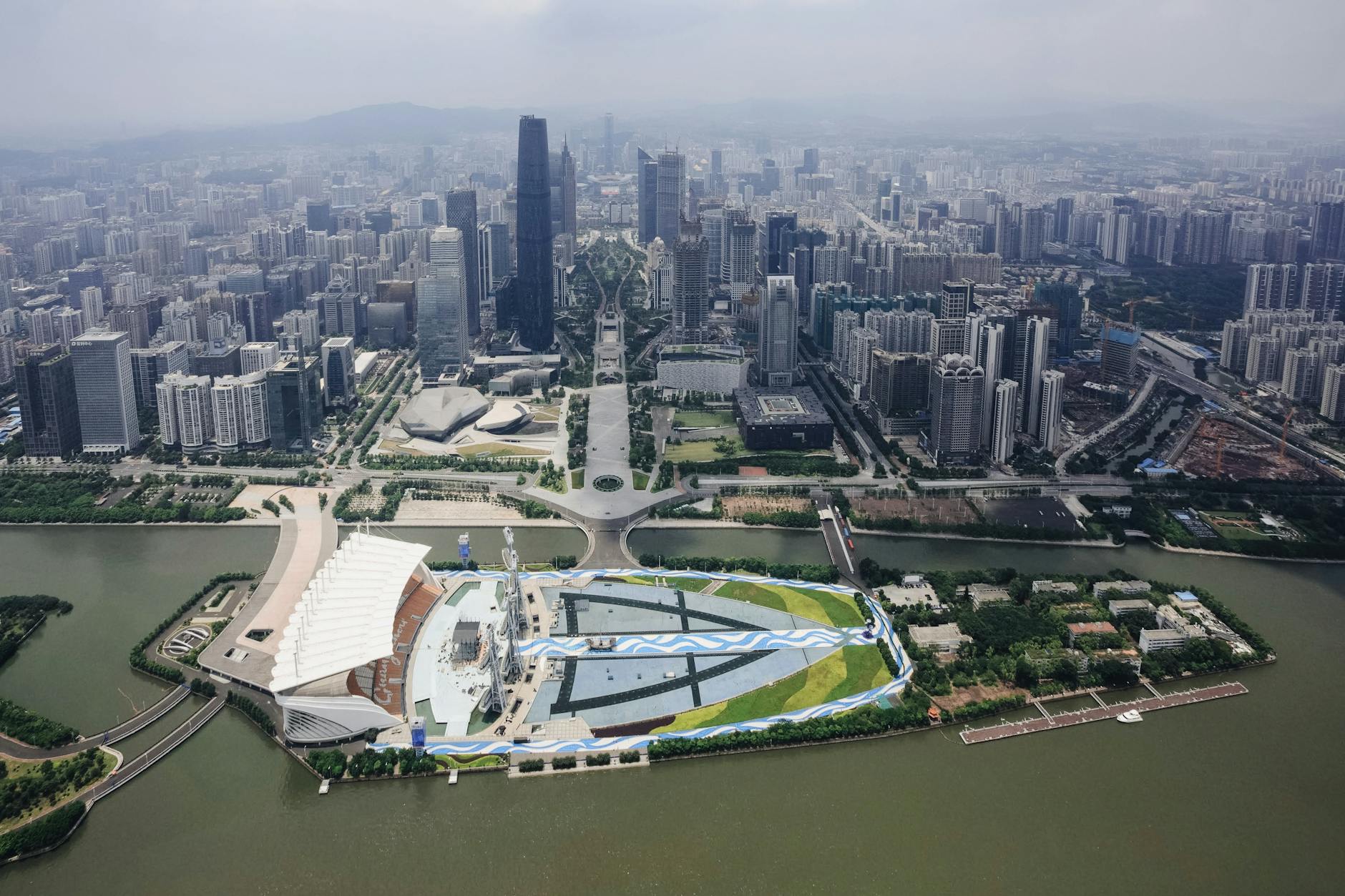

Incorporating wise investment strategies can significantly impact urban growth. Selecting SMSF investment options that align with sustainable initiatives can support the development of infrastructure projects. For instance, investments in local green initiatives present in the Melbourne Docklands could help bring about significant improvements in urban landscapes. These projects promote not only environmental sustainability but also economic viability in the area.

Promoting Economic Stability

Conservative investments can play a crucial role in maintaining economic stability. In a climate where uncertainty often looms, these investments offer a safety net. They provide consistent returns, protecting against volatility and helping cities like Melbourne plan for the future with a neutral yet secure stance. These strategies ensure cities can maintain critical services and invest in new projects without compromising financial health.

Encouraging Community Investments

Engaging communities in investment activities fosters a shared sense of ownership and responsibility towards urban projects. In Melbourne, community-driven initiatives, coupled with smart investment strategies, can be seen revitalizing areas like Fitzroy. Community investments make residents partners in development plans, helping cities grow sustainably and inclusively. Empowering residents to invest in their localities taps into an underutilized resource—community capital—and aligns financial growth with social progress, keeping urban spaces vibrant and interconnected.

Sustainable Growth Strategies

Eco-Friendly Urban Planning

Sustainable urban development is essential for keeping up with the dynamic vitality that Melbourne's green spaces, like the renowned Royal Botanic Gardens Victoria, offer. Eco-friendly urban planning can start with the integration of green roofs, permeable pavements, and urban forests, which naturally cool the environment and reduce energy consumption. The key here is thinking about how these elements can be interwoven into the urban tapestry to create more liveable and environmentally resilient cities.

Renewable Energy Investments

Directing a portion of your investment funds into renewable energy is not only an ethical choice but also a pragmatic one. Renewable energy projects, from solar farms to wind turbines, are becoming increasingly accessible and offer promising returns due to technological advancements. These investments also support a shift towards a more sustainable future, aligning with the innovative projects seen in the Melbourne Docklands. Crucially, this avenue offers a proactive way to contribute to and benefit from the renewable energy sector's growth.

Socially Responsible Investments

Choosing managed funds that prioritise socially responsible investing can align your financial goals with your values. These funds focus on companies that advocate for ethical governance, environmental stewardship, and social equity. For creatives and professionals engaged in fields that shape cultural narratives, tapping into socially responsible investments provides an opportunity not only for financial gain but for promoting impactful change. Opting for such funds empowers individuals to support businesses committed to sustainable practices akin to the trendy revitalization seen in Fitzroy.

Engaging with Managed Funds

Steps to Begin Investing

Embarking on your investment journey doesn't have to be daunting. Getting started with managed funds involves understanding a few essential steps. First, identify your financial goals. Are you aiming for short-term gains, or is building long-term wealth your priority? Once you've established that, it's time to assess your fixed income needs. Many in creative sectors, like Nathan, appreciate stability, so incorporating fixed income options can offer a steady stream of revenue.

The next step is researching different fund managers. Look for those whose objectives align with your goals and who have a solid track record of performance. Establishing a budget is crucial, too. Determine how much you can comfortably invest without straining your finances—Nathan might look for contributions that won't impact his lifestyle.

Tools for Investment Education

Acquiring knowledge is key to navigating managed investments successfully. With abundant resources available, the challenge is finding reliable tools. Consider online courses focused on wealth management to build your confidence and understanding. These programs often break down complex terms into digestible insights, making them perfect for budding investors.

Social media platforms are also treasure troves of information, with influencers who specialize in translating financial jargon into easily graspable content. Apps designed for investment education can further empower you, offering simulations and quizzes to test your understanding.

Monitoring and Adjusting Investments

As with any aspect of sustainable urban growth, maintaining a dynamic approach is essential. Regularly review your portfolio to ensure it's on track with your objectives. Market conditions change, and so should your strategy. Be prepared to adjust your investments as necessary to optimize performance. Staying informed and adaptable makes navigating the world of managed funds more accessible and rewarding.

Navigating Common Investment Mistakes

Misunderstanding Fund Types

As we navigate the vibrant avenues of finance, understanding the variety of managed funds is critical. Each fund type, like the carefully curated paths through the Royal Botanic Gardens Victoria, offers distinct benefits and aligns with different goals. A frequent misstep is confusing terms like balanced, growth, or income funds, each having unique risk levels and return expectations. Without a clear comprehension, investors might supporting a fund that doesn't truly match their objectives. It's akin to choosing a tree for its shade without realizing its seasonal nature.

Neglecting Diversification

A lesson from the innovative Melbourne Docklands is in diversity—whether in architecture or investment strategies. Neglecting diversification can inadvertently increase risk, a paradox in a world striving for stability. Investing all in one type of asset, much like concentrating development in a single space, can lead to vulnerabilities. Instead, aim for a mix across sectors and regions, just as Docklands showcases an array of uses and styles harmoniously coexisting.

Ignoring Long-Term Planning

In the creative heart of Fitzroy, rapid yet thoughtful revitalization reveals the value of long-term vision. Similarly, the best financial strategies for managed funds encompass time. Patience unlocks potential; rushing to see results can undermine overall objectives. Align investments with broader self managed super funds strategies, much like planting seeds that mature into resilience. Embrace the growth journey, for it is a patient yet fulfilling one, akin to watching Fitzroy’s eclectic culture blossom over the years.